State or local government officials who are paid on a fee basis: This is an uncommon occurrence.Earnings from other sources cannot exceed 10% of a person's total earnings. A performing artist, such as a musician or actress, must work for at least two companies in a year, earn a certain amount per employer, and have an adjusted gross income that has been stated. Eligible performing artists: This is a very specific criterion.Reservists in the Armed Forces: People of the reserve component of the military can continue to eliminate unreimbursed expenses.If you belong to one of the following categories, you can continue to deduct unreimbursed employee expenses: As a result, independent contractors and other company owners are able to deduct reasonable and necessary business costs.

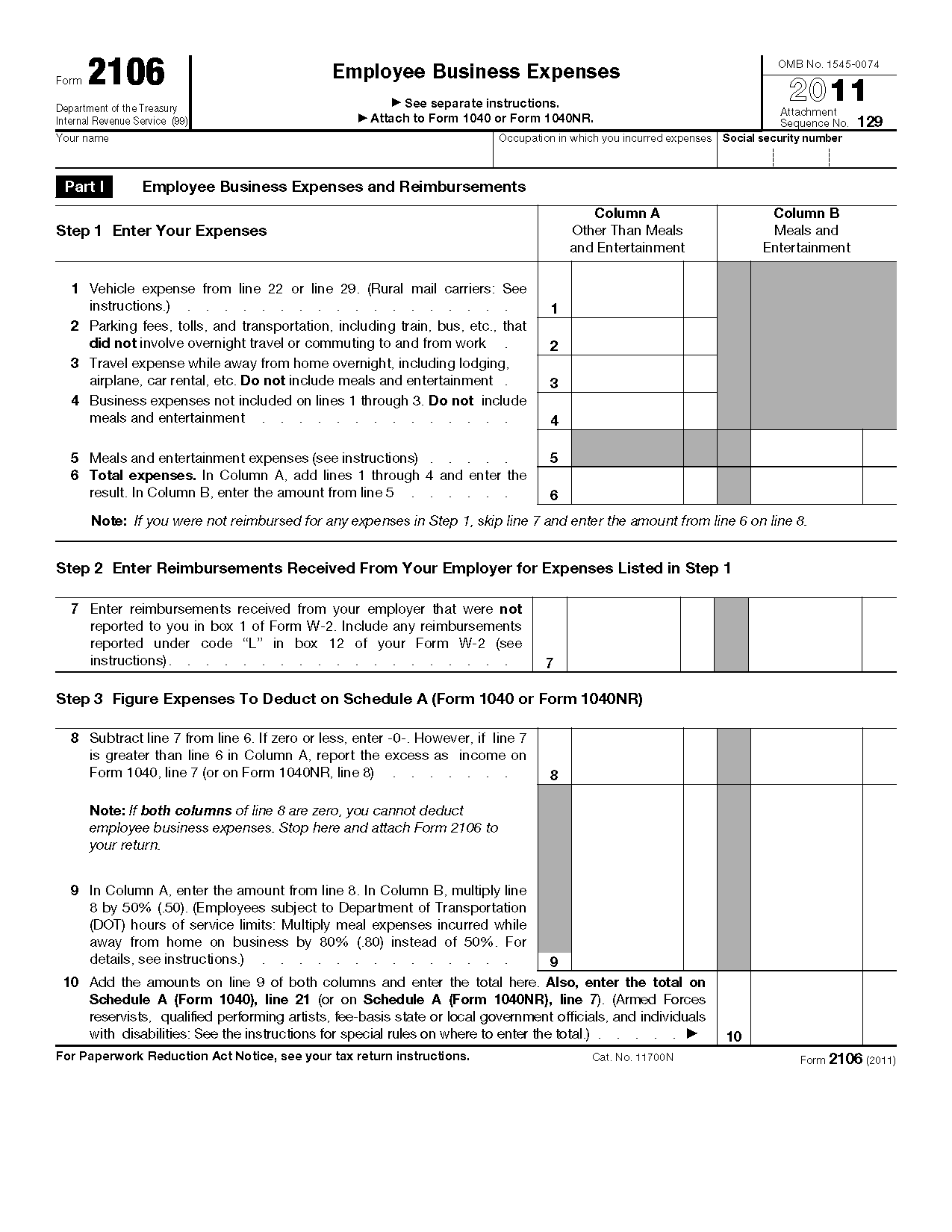

The TCJA ban lasts until 2026 when all workers will be able to take advantage of various itemised deductions again.Įmployee costs that are not repaid do not apply to persons who are not categorised as workers. With the exception of a few protected categories, the Tax Cut and Jobs Act (TCJA) eliminates unreimbursed employee expenditure deductions. In 2020, the vast majority of W-2 employees will be unable to deduct unreimbursed employee expenses. What About The Unreimbursed Employee Expenses in 2020? Are They Deductible? To minimise such losses, it is more crucial than ever for employees to request compensation from their employers for such expenses. The loss of these exemptions can have a significant financial effect on certain individuals, such as construction labours who write off expensive equipment or salesmen who have to go to customers on a frequent basis without receiving compensation from their employers. Unreimbursed employee expenses were deductible on Schedule A (Form 1040), line 21, or Schedule A (Form 1040NR), line 7 prior to the changes in tax regulations. There are additional exclusions for specific types of work, such as reservists in the Armed Forces, as well as educator fees for a certified educator. Individual contractors and non-wage earning self-employed persons, such as those filing Schedule C or Schedule F, are not covered by this provision. The Tax Cuts and Job Act (TCJA) removed all additional itemised deductions subject to the 2% of Adjusted Gross Income (AGI) limit between 20, including the exemption for unreimbursed employee expenses. Are Unreimbursed Employee Expenses Deductible In 2018?

Unreimbursed business expenses professional#

To be considered necessary, an expense does not have to be needed.Ī few examples of such expenses are instructors expenses, employment-related legal fees, licences and regulatory fees, professional society dues, private offices used by employers, passport feed for business trips, medical assessments required by employers, toolkits and supplies used at work, work clothes, work-related training, and so on. Ordinary expenses are those that are usual in your trade, organization, or profession, whereas necessary expenses are those that are important and beneficial to your business. Unreimbursed employee expenses are those for which your company has not compensated you or provided you with an allowance.Įmployee expenses are classified as usual and essential by the Internal Revenue Service (IRS).

Unreimbursed business expenses how to#

It's important to understand what unreimbursed employee expenses are and how to manage them before deciding how to effectively address these concerns. Not every employee expenses, however, are reimbursable. Also, keep track of these reimbursements since the startup can withdraw these payments from its taxes at the end of the year, amplifying your cash flow still again. The ability to deduct these expenses helps to offset the costs of beginning and maintaining a business, which improves your cash flow and bottom line.Īnyhow, what do you think about reimbursing employee expenditures? Employees sometimes pay for certain business expenditures out of their own wallets, especially in the early stages of a startup, in the hopes of being reimbursed by the organization.Įven if you're just getting started, it's a good idea to establish a policy on which costs are reimbursable and how to get reimbursement.

Many expenses related to the company, such as payroll, office rent, commercial insurance, and marketing expenses, are fortunately tax-deductible. These expenses may quickly escalate for most rising companies and startups before they can attract investors, especially as they scale. When you start a new company or a startup, you rapidly begin to incur expenses. Are you thinking to start your own company or owning a startup is your dream? Are you ready with a list of all the taxes and costs you'll have to deal with right away, such as reimbursed or unreimbursed employee expenses? No? Don’t worry, keep going!

0 kommentar(er)

0 kommentar(er)